What are TFS?

The term targeted financial sanctions (TFS) includes both asset freezing without delay and prohibition from making funds or other assets or services, directly or indirectly, available for the benefit of sanctioned individuals, entities, or groups.

Example: In case of DNFBPs, the provision of any services, such as legal services to transfer asset ownership, buying or selling real estate, selling jewelry, precious metals, natural resources, etc.

EOCN

The Executive Office for Control and Non-Proliferation (EOCN) was established in the UAE in 2009 as a body responsible for implementing the provisions of Federal Decree Law No. (43) of 2021 on the Commodities Subject to Non-Proliferation which replaces Federal Law No. (13) of 2007.

The EOCN, in cooperation with the Ministry of Foreign Affairs and International Cooperation (MoFAIC) and other government agencies exert extreme efforts in following up the application of the resolutions and requirements of the United Nations Security Council and other relevant international and regional organizations. EOCN also coordinates and supervises the application of targeted financial sanctions relating to terrorist lists system, as well as the implementation of Security Council resolutions on the prevention and suppression of terrorism, its financing, the cessation of arms proliferation and financing, in addition to other relevant resolutions in coordination with competent stakeholders.

The UAE, as a member of the UN, is committed to implement the United Nations Security Council Resolutions (UNSCRs), including those related to UN sanctions regimes. Consequently, through the Cabinet Resolution No. 74 of 2020, the UAE is implementing UNSCRs on the suppression and combating of terrorism, terrorist financing & countering the financing of proliferation of weapons of mass destruction, in particular, TFS regimes as defined by the UN.

All UN member states must implement freezing measures with regards to individuals or legal entities designated by the UNSC. In addition, UNSC Resolution 1373 (2001) mandates each UN member state to develop procedures to identify and apply freezing measures for individuals or legal entities that are suspected of, attempt to, and/or commit terrorist acts.

In the UAE, the Supreme Council for National Security (Supreme Council) prepares such designations. Specifically, the Supreme Council proposes a Local List that meets the designation criteria required by UNSC Resolution 1373 (2001).

Legal Framework

Article 16(e) of Federal Law No. 20 of 2018 (amended by Federal Decree No. 26 of 2021) requires the prompt application of the directives when issued by the competent authorities in the state for implementing the decisions issued by the UN Security Council under Chapter (7) of UN Convention for the Prohibition and Suppression of the Financing of Terrorism and Proliferation of Weapons of Mass Destruction, and other related directives.

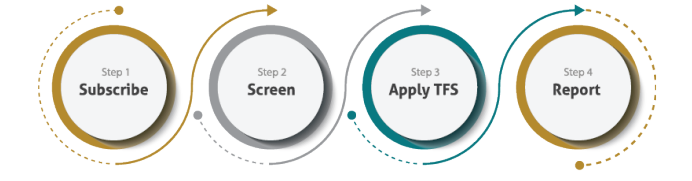

Who must comply with TFS?

Sanctions restrictions, including TFS measures, must be implemented by any Person (both natural and legal entities), including government authorities and FIs, DNFBPs, and VASPs located in the UAE and operating within the UAE’s jurisdiction.

Any Person (natural or legal) that performs activities that fall under the definition of FIs, DNFBPs, or VASPs as per UAE legislation has an obligation to register on goAML to be able to submit suspicious transactions/activity reports (STRs/SARs) to the UAE FIU, as well as to submit TFS reports (FFRs/PNMRs) to the Executive Office and the relevant Supervisory Authority.

FIs and DNFBPs that are not registered on goAML face the risk of being subject to administrative and/or financial sanctions by the relevant Supervisory Authority for failure to register on goAML.

Obligations on DNFBPs:

Consequences for FIs, DNFBPs, and VASPs Any Person, found to violate and/or be in non-compliance with the obligation.

The Cabinet Decision No. 74 of 2020 or failing to implement procedures to ensure compliance may face imprisonment of no less than one year and no more than seven years and/or a fine of no less than AED 50,000 (fifty thousand dirhams) and no more than AED 5,000,000 (five million dirhams). In addition, FIs, DNFBPs, and VASPs are subject to supervision, and in the case of identified noncompliance, Supervisory Authorities can apply the enforcement actions set out under Article (14) of Federal Decree No. 26 of 2021 Amending Certain Provisions of Law No. 20 for 2018 on Anti Money Laundering and Countering the Financing of Terrorism. The Supervisory Authorities of the FIs, DNFBPs, and VASPs have the legal capacity to supervise the implementation of TFS. The Supervisory Authorities may also issue the following administrative sanctions:

FAQ

The term targeted sanctions means that such sanctions are imposed against specific individuals, entities, or groups. The term TFS includes both asset freezing without delay and prohibition from making funds or other assets or services, directly or indirectly, available for the benefit of sanctioned individuals, entities, or groups.

Sanctions restrictions, including TFS measures, must be implemented by any Person (both natural and legal entities), including government authorities and FIs, DNFBPs, and VASPs located in the UAE and operating within the UAE’s jurisdiction.